Is BoAt-IPO Worth the Hype?

The year 2021 can be considered as a golden year for many Indian startups as many of them got listed on stock exchanges by launching the IPOs (Initial Public Offering). The list of listed startups includes Nazara Technologies, Zomato, CarTrade, Fresh works, Nykaa, Policybazaar, Paytm, MapmyIndia.

What is an IPO?

An IPO (Initial Public

Offering) is a process by which a private company can raise capital from the

general public by issuing its stocks.

BoAt’s Entry

On similar lines

boAt, a 6-year-old Indian start-up and the world’s 5th largest wearable

consumer electronics brand, is seeking to launch its IPO as it has filed the

DRHP (Draft Red Herring Prospects- A sort of document formed to introduce a

startup to the potential investors) of up to INR 2,000 Cr with market regulator

SEBI with a fresh issue of shares worth up to INR 900 Cr valuing it at INR

11,000 Cr., but here is a little catch, In Apr 2021, when boAt raised its 6th

funding of INR 50 Cr. From Qualcomm Ventures it is valued at INR 2,200 Cr, so

how it is valuing itself at 5 times of this number in just a 10-11month span?

Revenue Model

BoAt largely seeks revenue from its sale of fashionable earwear audio devices, including earphones, headphones, earbuds, wireless speakers, etc., through third-party retailers, including Amazon and Flipkart. It positions its products as fashionable, wearable instead of electronic items through its partnership with young influencers, including Hardik Pandya, KL Rahul, Diljit Dosanjh, Karthik Aryan, Kiara Advani by giving them the title of “BoAtheads”

Valuation before IPO

As per the Independent Auditor’s Report of 31st March 2020; the company is having authorized share capital of Rs. 700,000 viz., 600,000 of equity and 100,000 of preferences.

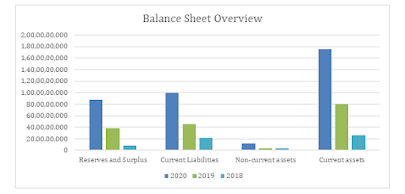

The profits hit an all-time high of Rs. 66.56 crore since its inception; which is almost 5 times higher than what it actually earned in the previous year 2019. In the past 2 years, the company has experienced enormous flourishing not only in terms of revenues and profits but in terms of debts too.

Dispensation after the IPO

As per the DRHP been filed so far, it’s mentioned that there would be an offering worth Rs. 1,100 crores for sale. Some amount would be used to offer the general public for direct investment and the rest would be utilized for the debt settlement.

Critical Analysis:

After

experiencing this kinda sudden hike in the statements of any company and that

too in a shorter span of time besides this vicious pandemic; it does raise

questions on the worthiness and durable competitiveness by all odds.

One thing not to be mistaken is that boAt is a company, importing the majority of its material (i.e., almost 89%) from China. This is what providing mightiness as can provide its stuff at reasonable prices and that too per the expectations of the customers. But being dependent on a single supplier and for that much, moreover the kind of relationship between the two countries; somehow would affect it in the future. Another thing to mull over is that boAt is highly dependent on a third-party retailer like Amazon and Flipkart.

Conclusion:

Listing on the

stock exchange is an ultimate way to give an enhancement to the company. In

contrast amid the last two years, there are numerous companies goes listed on

the Indian stock exchanges, is no exception; with one of them got the biggest

initial sale in the corporate history of India but performed disastrous on the

debut, none other than “Paytm”.

A company

performing well and good at the spot and almost at peak doesn't mean it will

provide with that much profit for a longer span of time; for that one should be

stable financially at least and should be having an advisable record for the

same.

References:

Informative!!!

ReplyDelete